Picture the moment just before a thunderstorm: the air goes still, static crackles on your skin, and you know something big is about to break. That’s where we sit with quantum computing today. After decades of chalk-dust theory and cryogenic tinkering, the technology has slipped the lab coat and started signing real contracts—powering drug-design models, hardening national security networks, reshaping chip-factory roadmaps. Governments are pledging billions, Fortune 500s are scrabbling for talent, and start-ups are racing to carve moats around every layer of the stack. The opportunity is massive, the risks are real, and the next five years will decide who owns the keys to tomorrow’s compute kingdom. This report is your field guide to that inflection point—highlighting the top quantum computing stocks to watch before the storm breaks.

What is Quantum Computing?

Quantum computing is the art of doing arithmetic with the raw rules of nature. Imagine a coin spinning in the air. While it spins, it is both heads and tails at once. Flip 50 coins and, for an instant, you have every possible heads-tails pattern simultaneously.

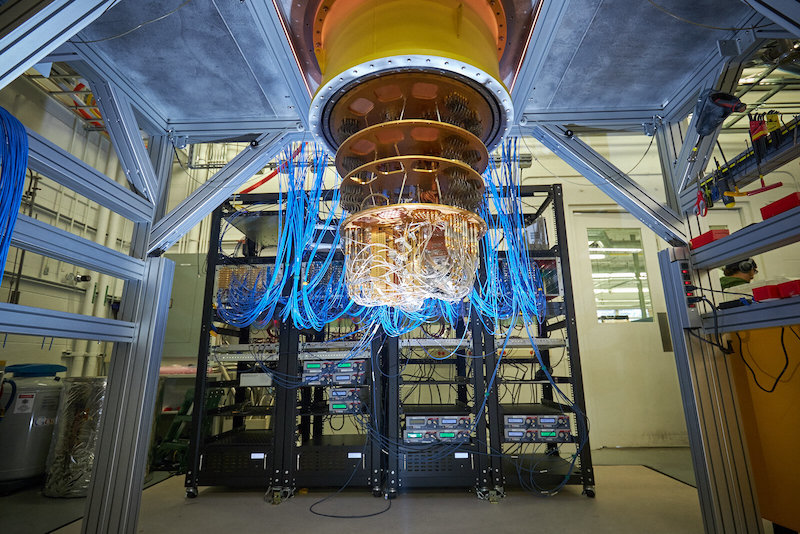

A quantum computer harnesses that “in-between” state—called superposition—inside tiny units of information called qubits. Qubits can also become entangled, meaning a change to one instantly echoes in its partner, no matter how far apart. By choreographing superposition and entanglement with precise microwave or laser pulses (the “gates”), quantum processors evaluate many solutions in parallel and let interference cancel the wrong answers.

Classical bits crawl one path at a time; qubits explore a whole maze at once and reveal the exit in a single measurement. That parallelism makes certain problems—molecular chemistry, supply-chain routing, cryptography—scale exponentially faster than on the biggest supercomputer.

Why quantum computing, why now?

Just to beat the analogy into the ground, we’re truly at a perfect storm of catalysts:

- Hardware milestones. On 10 June 2025, IBM unveiled “Starling,” a blueprint for the first fault-tolerant quantum supercomputer able to execute 100 million quantum operations with just 200 logical qubits—orders of magnitude beyond early lab demos. Starling is expected to be operational by 2029. With gate fidelities topping 99.9%, deeper cryogenics, and chip-to-chip photonic links, the industry has a credible path to commercial quantum computers.

- Early practical wins. Drug designers run quantum-accelerated simulations that cut modeling runtimes from months to days; automakers use hybrid quantum solvers to optimize battery materials and traffic routing; utilities test quantum annealers to shave megawatts off grid losses. Each result is niche, but taken together they prove a dollar value today—and that convinces CFOs to fund pilots next quarter.

- Capital floodgates. Venture and corporate investors poured $1.25 billion into quantum start-ups in Q1 2025 alone—more than double the prior year—and the check sizes are late-stage, not seed-round hobby money. That cash coincides with customers signing real, multi-million-dollar hardware and software contracts across pharma, logistics and national security.

- Government tailwinds. Nations view quantum like they once viewed nuclear energy or space flight—too strategic to outsource. Public commitments now top $55 billion worldwide, underwriting new fabs from New York to Tokyo. The National Quantum Initiative coordinates over a dozen agencies, while Europe, China, and the U.K. have launched rival programs.

- Demand-side urgency. Moore’s-law transistor scaling is sputtering just as AI, cryptography, and climate models demand ferocious compute. Quantum machines promise the kind of non-linear leap that classical CPUs and GPUs simply can’t deliver. And because quantum processors excel when paired with classical accelerators, every breakthrough echoes through data-center design, chip manufacturing, and cyber-security.

- The stack is professionalizing. Cloud giants now expose quantum processors behind familiar Python APIs. Keysight, Ansys, and Cadence ship design tools that let hardware engineers lay out qubits the way they draw RF filters. Standard workflows mean new talent can be productive in months, not PhD cycles, accelerating adoption.

- A deadline is looming for today’s encryption. In August 2024, NIST published the first three post-quantum cryptography (PQC) standards, warning that RSA and ECC could break once large-scale machines arrive. Governments and banks are now budgeting for a multi-year migration to post-quantum security.

Put together, quantum computing in 2025 feels like the internet in 1995: still quirky, occasionally noisy, but clearly crossing from science experiment to commercial platform. The next decade will crown winners and vaporize hype, yet the direction of travel is set. For investors, builders, and policymakers alike, the real risk is no longer “Will quantum work?” It’s “Will you be ready when it does?”

Quantum Hardware Developers (Pure-Plays)

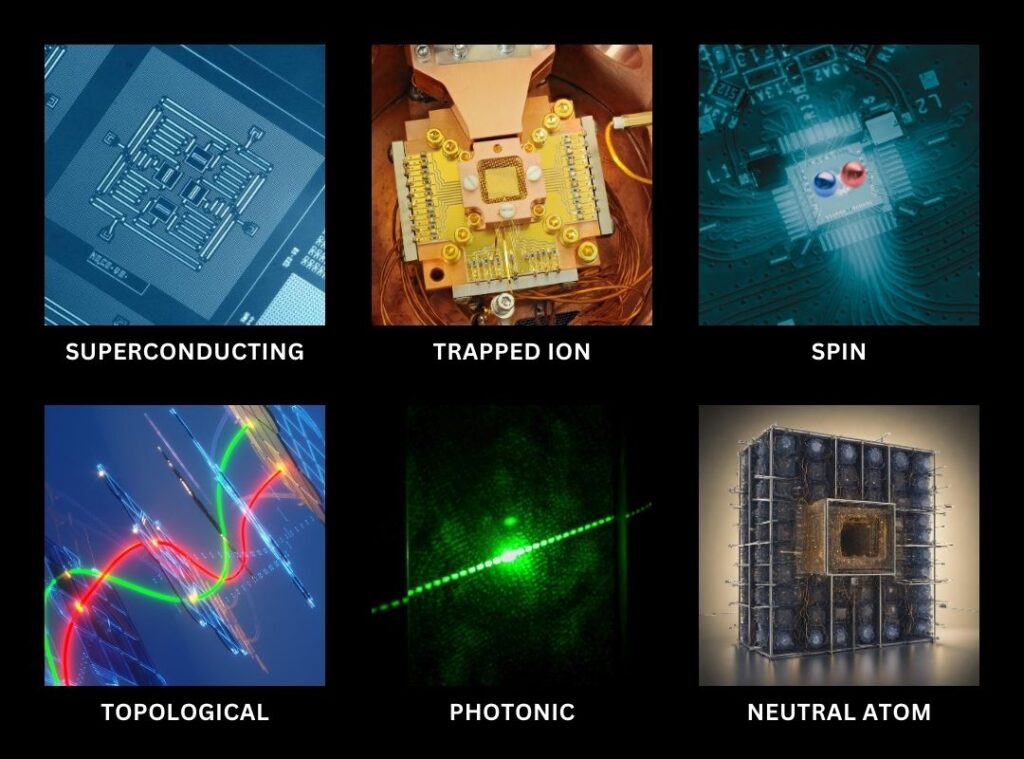

Quantum hardware developers fabricate the physical cores—ion traps, superconducting loops, photonic chips—where superposition and entanglement live. Every breakthrough expands the size of problems quantum machines can attack, from drug discovery to climate modeling. These companies are the engine builders: without a reliable, scalable processor, quantum algorithms are just white-board art.

Their race is brutal—physics, cryogenics, and control electronics must all move in lock-step—but whoever solves it owns the computational horsepower that will plug into clouds, data-centers, and even satellites over the decade ahead.

IonQ (NYSE: IONQ)

HQ: USA; Trapped-ion quantum leader with cloud-native systems.

IonQ is building quantum computers the way Apple builds iPhones: own the stack and polish every layer. Instead of super-cold superconducting chips, IonQ traps individual ytterbium ions in electromagnetic fields. Each qubit stays coherent for seconds (not microseconds) and delivers two-qubit fidelities near 99.9 percent, so fewer physical qubits are needed to create one error-corrected logical qubit. Management has a public roadmap to leap from today’s 35-qubit Forte machines to 80,000 logical qubits—enough for fault-tolerant, at-scale work—before 2030.

Momentum is real. Full-year 2024 revenue doubled to $43 million and bookings hit $95.6 million, both at the top of guidance, showing buyers are paying—not just experimenting. Even after heavy R&D, IonQ sits on $364 million of cash, giving years of runway to hire physicists instead of bankers.

Strategically, IonQ is turning hardware advantage into platform moat. Its systems run on Amazon Braket, Azure Quantum, and Google Cloud, letting developers test ideas with a credit card. Recent acquisitions tighten that moat: ID Quantique adds quantum-networking know-how, while Oxford Ionics brings chip-level photonics that should speed mass manufacturing and shrink error rates.

Of course, scaling throughput and gate speed versus superconducting rivals won’t be trivial, and deep-tech burn rates are unforgiving. But if IonQ stays on roadmap, it could end up wearing the “Intel Inside” sticker of quantum.

Rigetti (NASDAQ: RGTI)

HQ: USA; Superconducting qubit contender with in-house fabrication.

Rigetti is the focused underdog of superconducting qubits. Superconducting qubits switch in nanoseconds, making them the workhorse for algorithm research. But while IBM and Google’s size mean quantum will always be a side hustle to them, Rigetti is pure play and vertically integrated. Rigetti owns Fab-1 in Fremont, California and designs everything from qubit metal to control software. The company has committed to shipping a 100-plus-qubit processor with 99.5 percent fidelity by the end of 2025—a threshold for serious error-correction experiments.

Financially the story is small but solvent: 2024 revenue was $10.8 million and cash stood at $217 million, enough runway for several years of iteration. Operating losses remain heavy, but management cut non-core spend and focuses on hitting technical milestones.

What makes Rigetti interesting is focus. Owning the fab lets it iterate materials and layouts faster than giants tied to legacy nodes. That agility has already landed DARPA Quantum Benchmarking work in the U.S. and a £3.5 million U.K. consortium on real-time error correction—early-access customers that validate the tech and bring nondilutive funding.

The key for Rigetti will be execution: timelines have slipped before, illustrating how hard superconducting scale-up is. Yet if its modular chips hit fidelity targets, even a sliver of the future quantum-as-a-service market could make today’s micro-cap valuation look cheap.

D-Wave (NYSE: QBTS)

HQ: USA/Canada; Annealing-based quantum systems for optimization use cases.

D-Wave sells quantum machines for the gritty problem of optimization. Rather than chase universal gate-model supremacy, it spent two decades perfecting quantum annealing, a specialist approach that excels at route planning, staffing, and supply-chain tweaks. In May 2025, the company launched its sixth-generation Advantage2 system—four 400-plus qubits with denser connectivity—available today via the Leap cloud or on-prem hardware.

Basically, customers are paying for “good-enough” quantum now. Full-year 2024 revenue hit $8.8 million, bookings a record $23.9 million, and the roster expanded to 135 organizations, including 28 Global 2000 names. A series of ATM and ELOC financings lifted cash above $300 million, giving the runway to both scale annealers and prototype a gate-model line in parallel.

D-Wave is also pursuing software moats. Its Hybrid Solver Service blends classical heuristics with quantum annealing, consistently beating pure-classical baselines on cost, speed, and energy. As AI explodes, optimization becomes the hidden tax on inference; D-Wave’s machines can cut that bill today.

So what’s the catch? Annealing isn’t universal computing, and academics still debate “quantum advantage.” But paying customers care about answers, not ideology. For investors, D-Wave offers a differentiated play on near-term quantum utility—an income stream while the rest of the sector waits for error-corrected nirvana.

Quantum Computing Inc. (NASDAQ: QUBT)

HQ: USA; Photonic quantum platform with integrated chip and software stack.

Quantum Computing Inc. wants to shrink quantum hardware from “super-fridge” to server-rack. Its Dirac-3 system uses room-temperature photonic qudits (a more generalized qubit with 200-level variables) instead of fragile superconducting qubits, packing the equivalent of ~11,000 qubits into a 5-U chassis priced at about $300k—cheap enough for corporate IT budgets.

To lock in supply and margin, QCi flipped the typical fab-lite playbook: in March 2025 it opened a thin-film lithium-niobate foundry in Tempe, Arizona. Owning the fab lets QCi iterate faster and sell “picks-and-shovels” photonic chips—modulators, single-photon detectors—into telecom, AI-photonics and sensing, creating a second revenue stream while de-risking its own roadmap. Early traction is real: NASA has awarded five contracts that use Dirac-3 for LiDAR data and phase-unwrapping workloads, giving the machine credible third-party validation.

Yes, sales are embryonic—under $0.4 million for all of 2024—but the balance sheet isn’t. Cash hit $78.9 million at year-end 2024, and a subsequent $100 million raise extended runway well past 2027, allowing QCi room to chase scale without tapping the market again.

Buying QUBT is effectively a venture-style call option. If photonic qudits emerge as the winning architecture for optimization and AI acceleration, Tempe could become the “TSMC of quantum photonics.” If the tech stalls, dilution will sting.

Quantum-Ready Foundries

Quantum-ready foundries are the chip factories that bend silicon—and sometimes niobium or indium phosphide—to quantum’s strange demands. They etch Josephson junctions only a few hundred nanometres wide, deposit ultra-pure metals, and package die so cold leaks or stray photons never reach the qubits. In short, they translate lab recipes into repeatable wafers. Without them, prototype processors stay trapped in white-gloved university cleanrooms.

By offering mature-node, radiation-hardened, or photonic flows, these fabs let hardware start-ups iterate fast and governments secure “on-shore” supply. They are the welders of the quantum supply chain, turning physics breakthroughs into shippable products.

SkyWater Technology (NASDAQ: SKYT)

HQ: USA; Government-trusted foundry with quantum and defense exposure.

SkyWater is the “Made-in-America” foundry that sells agility, not scale. Its 200 mm Bloomington fab is one of just two DMEA-accredited Trusted facilities in private hands, making it the go-to shop for rad-hard chips, MEMS sensors and even superconducting qubits that the Pentagon can’t source in Taiwan or Korea. In December 2024, the Commerce Department offered up to $16 million in CHIPS Act incentives, money that will turbo-charge a broader $350 million modernization program and lift capacity 30%—a tiny sum for TSMC, but a life-changing upgrade for a niche fab like SkyWater.

The company is morphing from job-shop to platform. Its new ThermaView infrared-imaging ROIC and advanced-packaging line in Florida give it proprietary product leverage, while the acquisition of Infineon’s Fab 25 in Austin would add 300 mm volume and a guaranteed $1 billion customer contract, plugging SkyWater into the mainstream automotive and industrial nodes that big defense primes still crave.

Financially, this is an R&D house wearing a hard hat: Fiscal 2024 revenue hit $342 million, up 19% YoY, and the company eked out its first non-GAAP profit while still spending 14% of sales on R&D. Yes, cash is tight and government budget hiccups can whipsaw orders, but every dollar of capacity is effectively “pre-sold” to defense, quantum-computing, and space customers who value trust over pennies.

As the only pure-play, U.S.-owned foundry that welcomes low-volume, defense-grade and quantum chips, SkyWater is a levered bet on supply-chain sovereignty. If Washington keeps writing checks for secure silicon, SKYT could scale from boutique to strategic asset. If subsidies stall, its micro-scale economics get exposed.

GlobalFoundries (NASDAQ: GFS)

HQ: USA; Specialty foundry scaling mature-node and quantum-adjacent chips.

GlobalFoundries is the world’s biggest “specialty” fab, minting the radio-frequency, power, automotive and silicon-photonic chips that TSMC’s bleeding-edge lines overlook. Two policy tailwinds now super-charge that niche.

First, the U.S. Commerce Department awarded GF up to $1.5 billion in CHIPS Act grants to triple capacity at its Malta, NY campus, modernize Vermont into a GaN power hub, and lay foundations for a brand-new fab on the same site. Second, AI’s hunger for low-power edge silicon has pushed major customers—Apple, SpaceX, AMD, Qualcomm and GM—to co-fund expansion. In June 2025, GF unveiled a $16 billion U.S. cap-ex plan, including $3 billion of fresh money aimed squarely at AI-centric processes and advanced packaging.

Unlike pure-play mature-node rivals, GF also owns fabs in Germany and Singapore, giving it geographic hedging while letting Europe bankroll a 300 mm Dresden expansion for FD-SOI and automotive chips. That distributed footprint is sticky: carmakers won’t dual-source safety ICs to China, and the U.S. government needs a “second foundry” for secure designs.

Numbers back the thesis. Fiscal 2024 revenue came in at $6.75 billion with $1.1 billion in free cash flow, even after a write-down that produced a GAAP net loss. Gross margin sits near 22%, well above the low-teens of many mature-node peers, thanks to long-term take-or-pay contracts that smooth the cycle.

Risks remain: cap-ex blowouts, talent scarcity in upstate New York, and customers eventually dual-sourcing once subsidies fade. But if Washington and Detroit really want a resilient chip supply, GF is the toll-booth they must pay. That makes GFS less a moonshot, more a regulated utility with semiconductor upside.

Post-Quantum Security

Post-quantum security is the digital seatbelt designed for roads not yet paved. When scalable quantum computers arrive, today’s RSA and ECC schemes can be cracked in hours, exposing bank accounts, medical records, even critical infrastructure. Post-quantum cryptography swaps those vulnerable math puzzles for lattice, hash-based, or multivariate equations that withstand Shor’s algorithm.

The field spans software libraries, hardware secure elements, and quantum-true random number generators, all engineered to drop into existing networks with minimal friction. As governments mandate migration timelines and hackers harvest data now to decrypt later, post-quantum tools become the insurance policy every connected device must carry forward.

Arqit Quantum (NASDAQ: ARQQ)

HQ: UK; Post-quantum encryption software targeting telecom and defense.

Arqit ditched its dream of launching quantum satellites in 2022 and pivoted to pure software. That focus is crystal-clear in 2025: its Symmetric Key Agreement (SKA-Platform) and NetworkSecure products drop one-time symmetric keys into any network, wiping out the RSA “Q-Day” threat without ripping out hardware.

The go-to-market is B-to-B-to-B. Arqit sells licenses to integrators and telecom operators who embed the tech in their own services. Momentum is finally showing. This spring Arqit landed its first U.S. DoD program-of-record, plus a three-year deal with a Tier-1 carrier spanning 32 countries—contracts expected to scale to seven-figure annual recurring revenue as end-customers turn them on.

Arqit is also riding Intel’s confidential-computing wave: running NetworkSecure inside Intel TDX enclaves and a CSfC-compliant mobile stack proved the code can protect data all the way from edge devices to classified networks with almost no latency tax, a big selling point for 5G and AI workloads.

Reality check: revenue for the first half of FY-25 was just $67k, against a $17.8 million operating loss, and cash sits at $24.8 million—about ten quarters of runway at today’s $2.4 million monthly burn. That means execution risk is high, and a capital raise is likely unless big contracts activate soon.

For investors, Arqit is a leveraged play on the coming mandate for quantum-safe crypto. If regulators force telcos and government suppliers to upgrade, Arqit’s simple, drop-in software could scale fast. If adoption drags, or if NIST-standard PQC becomes a commodity giveaway, dilution will follow.

SEALSQ (NASDAQ: LAES)

HQ: Switzerland; Secure chipmaker embedding post-quantum cryptography.

SEALSQ sells the digital padlocks that tomorrow’s robots, cars, and satellites will need once today’s encryption breaks. Spun out of WISeKey in 2023, the company embeds post-quantum “RootKey” circuitry straight into secure-element chips. That gives every device a hardware anchor that can swap to lattice-based keys the moment regulators say “Q-Day” has arrived. The model is already proven: SEALSQ parts protect 1.75 billion devices in smart-home hubs, chargers, and industrial sensors today, a huge installed base to upsell with firmware-based PQC.

FY 2024 sales were only $11 million, but cash sits at $85 million, and confirmed 2025 bookings of $6.8 million suggest growth is restarting after chip-cycle turbulence. To widen its moat, SEALSQ is buying French ASIC designer IC’ALPS, adding 100 engineers and instant automotive credibility; the deal should close in Q3 2025.

The tech roadmap keeps pace. June’s launch of a quantum-resilient security framework for autonomous robots pairs SEALSQ silicon with WISeKey’s PKI so that robots can prove identity and accept signed updates even in hostile networks. Think “TPM for Terminators.”

For SEALSQ, execution and scale will mean everything. Revenue is tiny, production still rides outsourced fabs, and the IC’ALPS integration must clear French regulators. But if policymakers force quantum-safe hardware into every connected gadget—and defense buyers keep prioritizing “trusted” supply—SEALSQ could become the NXP of the post-quantum era.

Quantum eMotion (OTCMKTS: QNCCF)

HQ: Canada; QRNG developer using quantum tunneling for secure entropy.

Quantum eMotion bets that randomness is the real scarce resource in cybersecurity. Its tunnel-junction Quantum Random Number Generator (QRNG) spits out high-entropy bits at >1 Gbit/s and, crucially, has now been taped out as a CMOS hybrid chip with TSMC—meaning it can be stamped by the million and dropped straight into phones, routers or data-center NICs.

Monetization is already starting. In February 2025 Quantolio paid US$1 million for a non-exclusive license to embed Quantum eMotion’s Entropy-as-a-Service in AI trading models; a month later Krown chose the same engine for its quantum-secured crypto wallet, layering in a revenue-share on unit sales. These early, software-heavy deals prove the business model scales without fabs.

Financials are embryonic but stable. 2024 revenue was effectively nil, and the company posted a C$2.97 million loss, yet it ended March 2025 with C$11.6 million in cash and closed an additional C$10 million LIFE financing to fund U.S. market expansion via its new Irvine office. That’s roughly three years of runway at current burn.

The bear case: bigger chipmakers could license NIST’s open QRNG IP and commoditize the space. The bull case: every SSL handshake, IoT sensor, and blockchain uses random seeds; embedding a certified quantum source is the easiest compliance box to tick. If QRNG chips become as ubiquitous as accelerometers, Quantum eMotion’s licensing model could compound well before full-scale quantum computers arrive.